south carolina inheritance tax waiver form

Exact Forms Protocols Vary from State to State and. Other taxes such as federal income tax gift tax or inheritance tax may also be incurred by a quitclaim deed transfer.

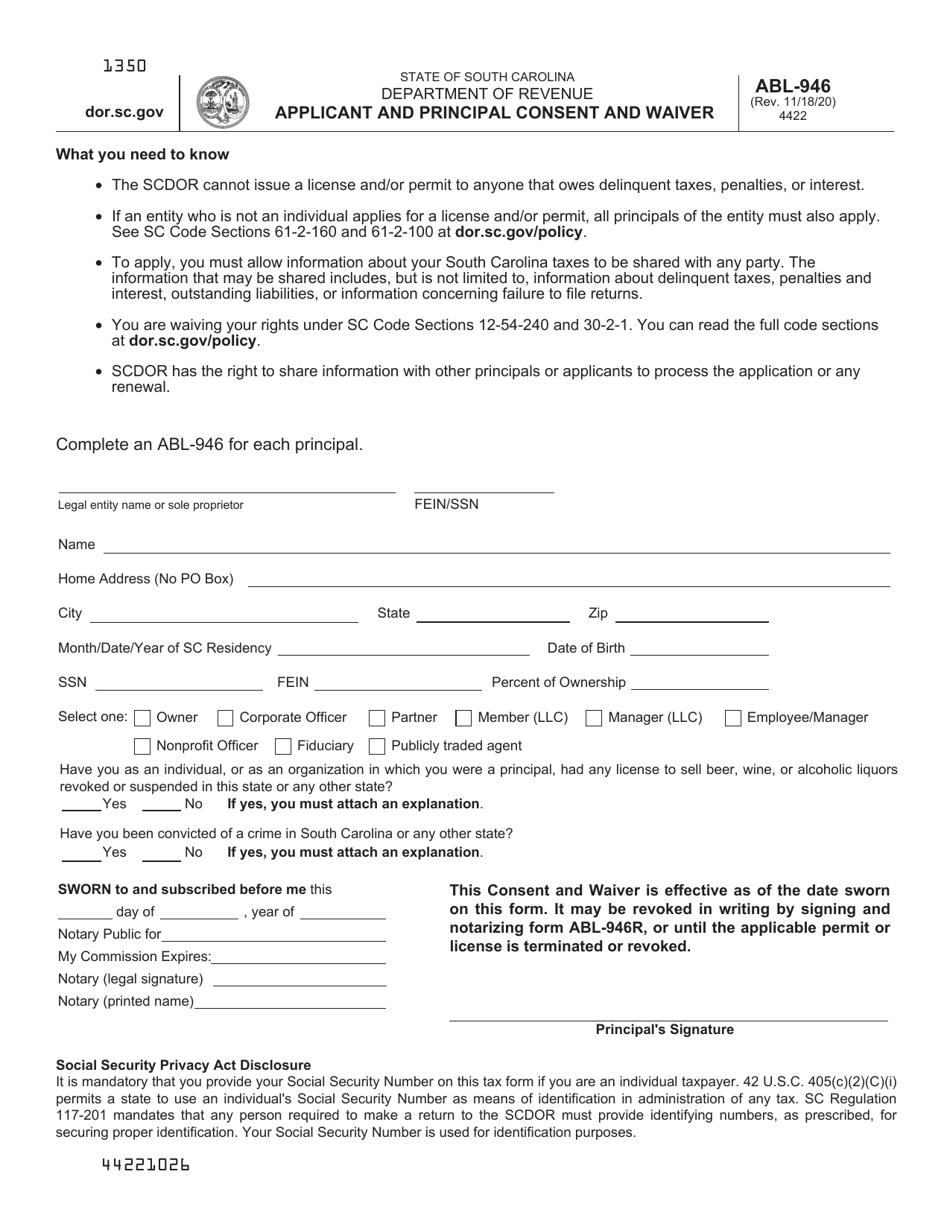

Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller

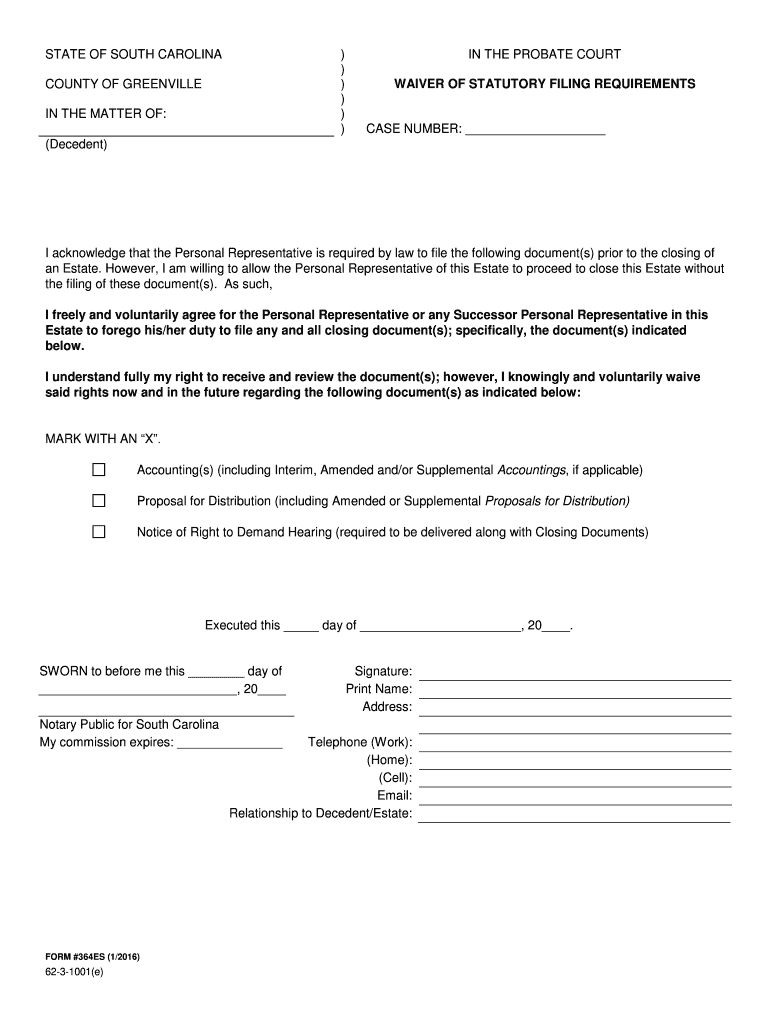

Waiver of Statutory Requirements and Beneficiary ReceiptRelease.

. Neither state has an inheritance or estate tax. Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative. Effect of Amendment The 2013 amendment substituted means for shall mean.

This doesnt mean youre stuck though. The executor has authority from the county probate court to act in this role but that doesnt necessarily mean that the executor has the final say on all decisions regarding the estate. If a price has been paid for the transfer that amount is.

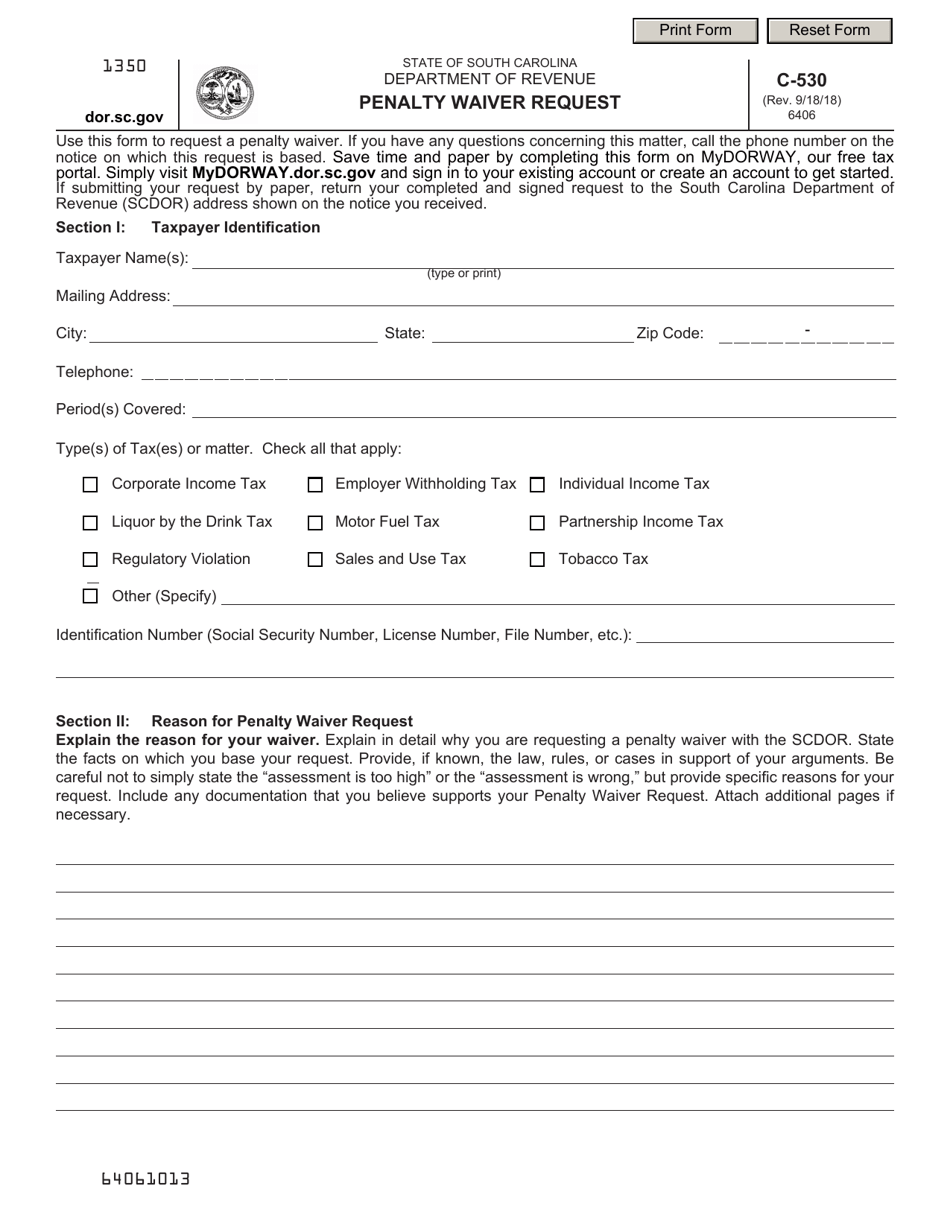

The executor of a will is in charge of making sure the wishes of the deceased are carried out as well as handling the final affairs of the estate. Waiver of all tax penalty and interest. This article may be cited as the South Carolina Trust Code.

If you sign a waiver and consent document you may later be barred from exercising your rights in the estate proceeding in the future. Instructions for Motion for Emergency Relief and Hearing. Stay with us and well give you a solution to how you can start the sale process.

Tennessee repealed its estate tax in. During this phase the court appoints the executor or a representative. To transfer title by quitclaim a quitclaim deed form must be in writing to be valid.

This article may be cited as the South Carolina Uniform Power of Attorney Act. It maintains its tax. Please consult with your financial advisoraccountantattorney No tax is claimed upon the following items of property described as being in your possession or under your control in your report of _____ relating to the estate of_____ late of _____.

Youll need to provide a death certificate will and a petition form. 279 S778 Section 1 eff January 1 2017. Interest and penalties waived.

Consult a tax lawyer. Statement of Creditors Claim. If you file a South Carolina tax return either as a resident or a non-resident you may be eligible for additional tax advantages.

In fact the answer is yes it is possible to disclaim inheritance rights and have the assets you were supposed to. View and download Cumberland County forms and information by subject such as Adult Probation and Parole including DUI program Clerk of Courts criminal forms including subpoena and expungement District Attorney forms and information for alternative punishment and juvenile programs Domestic Relations child support Prothonotary civil forms Register of. For example if you bought a car or a house and cannot continue paying the monthly instalments you cannot file a claim of exemption on that particular house or car.

The property lien is in effect until the. South Carolina Uniform Power of Attorney Act Part 1 General Provisions SECTION 62-8-101. For eligibility refer to Form 12277 Application for the Withdrawal of Filed Form 668Y Notice of Federal Tax Lien Internal Revenue Code Section 6323j PDF and the video Lien Notice Withdrawal.

During this time you cant do anything with the property other than maintaining it. Connecticut and New York have some form of a gift tax and estate tax as well. 1 Agent means a person granted authority to act for a principal.

Generally the document is used if a person dies without a will and the probate court is trying to determine how the estate should be distributed. Your child inherits your tax basisbasically what you paid for the propertywhen you transfer it to them as a gift during your lifetime. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Inheritance Tax Waiver This Form is for Informational Purposes Only. An agreement allows you both to confirm. However most states provide various exemptions from the transfer tax such as transfers between parents and children.

NC has slightly higher property taxes as a of home value. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return 24000 for a couple filing. If the debt originated from the purchase improvement or loan on that property then it cannot be exempt.

100 Section 2 eff January 1 2014. If the beneficiary is the spouse of the annuitant the spouse can change the contract into his or her own name. The transfer tax is usually a small percentage of the consideration or purchase price.

Future Scholar account contributions may be tax-deductible up to the maximum account balance limit of 52000 0 per beneficiary or any lower limit under applicable law. Personal Representative Affidavit of Adeemed or Abated Property. South Carolina Amnesty Page.

When you withdraw money to pay for. New Jersey phased out its estate tax in 2018. An Affidavit of Heirship is a written solemn oath that verifies the named individual is a legal heir of someone who died.

North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. Receiving an inheritance can provide a financial windfall but there are some scenarios where you may prefer not to receive one. This effectively records the lien.

By executing a waiver and consent document the distributee waives his or her right to a citation being issued by the court and consents to the courts appointment of the administrator or executor. In previous years Penn State only issued Form 1098-T to international students who requested it. This legal document includes a legal description of the property that is being deeded the county it is located in date of transfer and the names of the grantor person transferring the property and grantee person receiving the property.

Taxes due prior to January 1 2015 or taxes for taxable periods that began before January 1 2015 are eligible. In that case you might be wondering if its possible to decline an inheritance and the responsibilities that go with it. Exemptions may not be available for certain tax liens.

Inheritance tax is not a death tax inheritance tax is a transfer tax it a gift tax so if you give away too much away to a business or to a trust you may end up paying inheritance tax today while still alive but if you give money family and friends you can give away as much as you want and provided you survive for 7 years no problem but if you die within 7 years it will be. You should use a living together agreement when you and your partner know you will live together for a long time but do not want to get married. Students who file income taxes in the United States can use the Form 1098-T as an informational tax document used to determine eligibility for income tax credits.

Demand for Notice of Hearing in a Guardianship Conservatorship or Protective Proceeding. For purposes of this article. Waiver by Alleged Incapacitated.

Once this time has passed the judgment creditor can acquire an abstract judgment form from the clerks office at the court were the case was heard. Alabama Colorado Iowa Kansas Montana Rhode Island South Carolina Texas and Utah. Instructions for Notice of And Motion for Temporary Relief and Hearing.

Income Taxes South Carolina has a very high maximum tax rate of 7 that begins at a quite low income of 15400. In this article unless the context clearly indicates otherwise Code means the South Carolina Trust Code. Informal or common-law marriages can be entered into in these states.

What If the Recipient Sells the Property. The judgment debtor should also be notified. After a change in ownership the contract continues as if the surviving spouse owned the original contract.

The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. South Carolina Counties. June 30 2016 - August 30 2016.

If they turn around and sell the house for its 200000 value but you only paid 50000 for the property way back when. It later turned around and repealed the tax again retroactively to January 1 2013. The Form 1098-T is the tax document used to report these payments.

This abstract of judgment is taken to the county recorders office in each county where the real property is located.

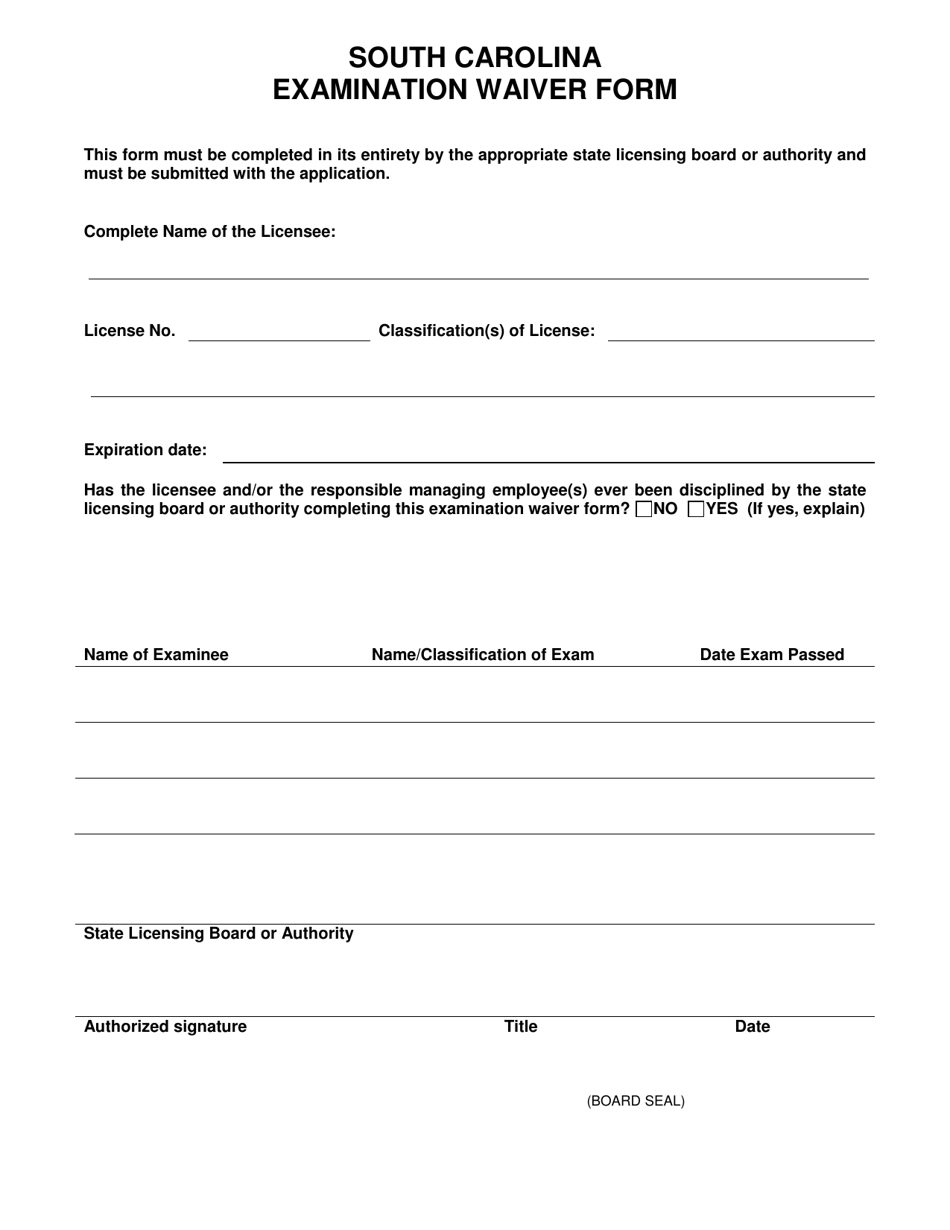

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

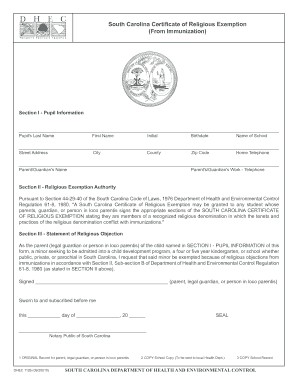

Sc Religious Exemption Form For Adults Fill Out And Sign Printable Pdf Template Signnow

Aetna Medical Claim Form Download The Free Printable Basic Blank Medical Form Tem Professional Reference Letter Reference Letter Template Signs Youre In Love

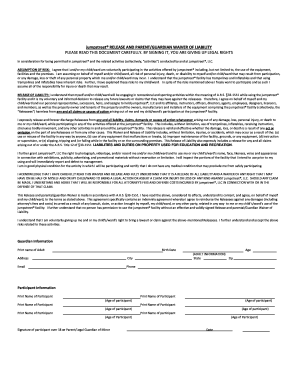

Cal South Waiver Form Fill Online Printable Fillable Blank Pdffiller

Bill Of Sale Form South Carolina Assumption Of Risk Waiver And Release Of Liability Templates Fillable Printable Samples For Pdf Word Pdffiller

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing Contract Template

2016 2022 Form Sc 364es Fill Online Printable Fillable Blank Pdffiller

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Form C 530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller